Report May 2023

NEW ZEALAND – THE JOBS REPORT, JANUARY – MARCH 2023

Analysis

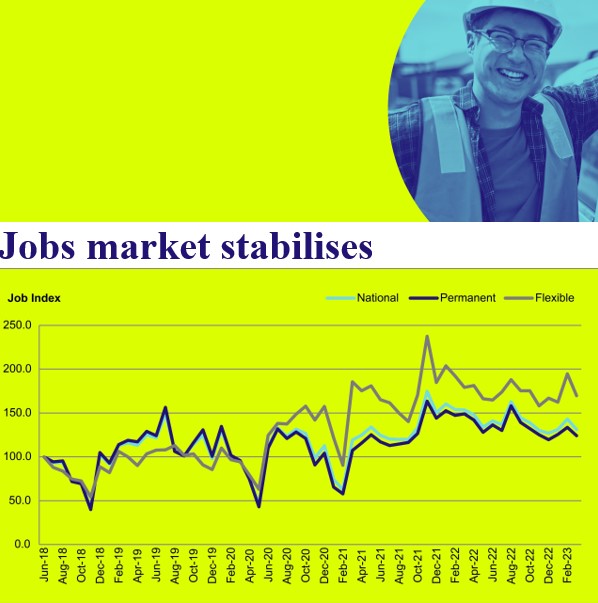

The first quarter of 2023 has seen some stabilisation in the New Zealand jobs market. Our New Zealand Jobs Index rose 3.3% in Q1 2023. In the December 2022 quarter the market contracted by 22.4% in response to a significant decline in business confidence.

Business confidence remains in the doldrums (ANZ Business Outlook March 23) but the rate of decline has slowed. While the New Zealand Jobs Index has fallen 14.7% since this time last year finding staff remains one of, if not the greatest challenge facing business. A softening market will help rebalance demand and supply.

The unemployment rate in December rose from 3.3% in September (a historical low) to 3.4%. In our last report we predicted unemployment rising further. We still believe this to be the case. A burst in job postings in January suggested some recovery but this was short lived. Demand fell after that.

One positive development from last quarters data was the improvement in permanent work. The permanent market rose 3.7% in the quarter. This reverses some of the decline seen in 2022. The fall year on year is now 16.8%.

Flexible jobs have held up better year on year, declining just 5.2% in the last twelve months. A move towards flexible workforce solutions is a feature often seen when business confidence is low and business conditions uncertain.

Executive summary

The New Zealand Jobs Index rose 3.3% in the first quarter of 2023 reversing some of the decline seen in Q4 2022. Job postings remain down 14.7% year on year.

A positive development was the 3.7% recovery in permanent work, reversing some of the decline seen in 2022.

Flexible jobs have held up better year on year, declining just 5.2%. A move towards flexible workforce solutions is often seen when business confidence is low and business conditions uncertain.

Education and Training rose 8.6%. Employers are focusing increasingly on training to develop their staff in the face of inadequate supply of particular skills in the open market.

Accommodation was the worst hit sector in late 2022. After a 33.1% collapse in the December quarter a 7.0% rise this quarter is modest by comparison.

Job opportunities in crucial industry sectors such as Construction and Manufacturing have changed little since December but Banking and Insurance employment continues to retreat.

It’s been a surprisingly strong start to the year across most professions. Demand for Business Professionals rose 17.8% and Technology professionals by 15.0%.

Demand for Trades and Technicians and Labourers, Drivers and Operators fell in the first quarter, by 10.5% and 9.1% respectively. This is attributable to the difficulties faced by the Construction sector. Ironically Cyclone Gabrielle may help turn this around.

Wellington experienced a 12.8% rise in job postings. A good proportion of these will be Public Sector appointments.

Gisborne and Hawke’s Bay both suffered substantial declines in job postings, an immediate consequence of the cyclone. We expect that decline to reverse in the months ahead as rebuilding creates work in areas worst affected by Cyclone Giselle.

.jpg)

.png)